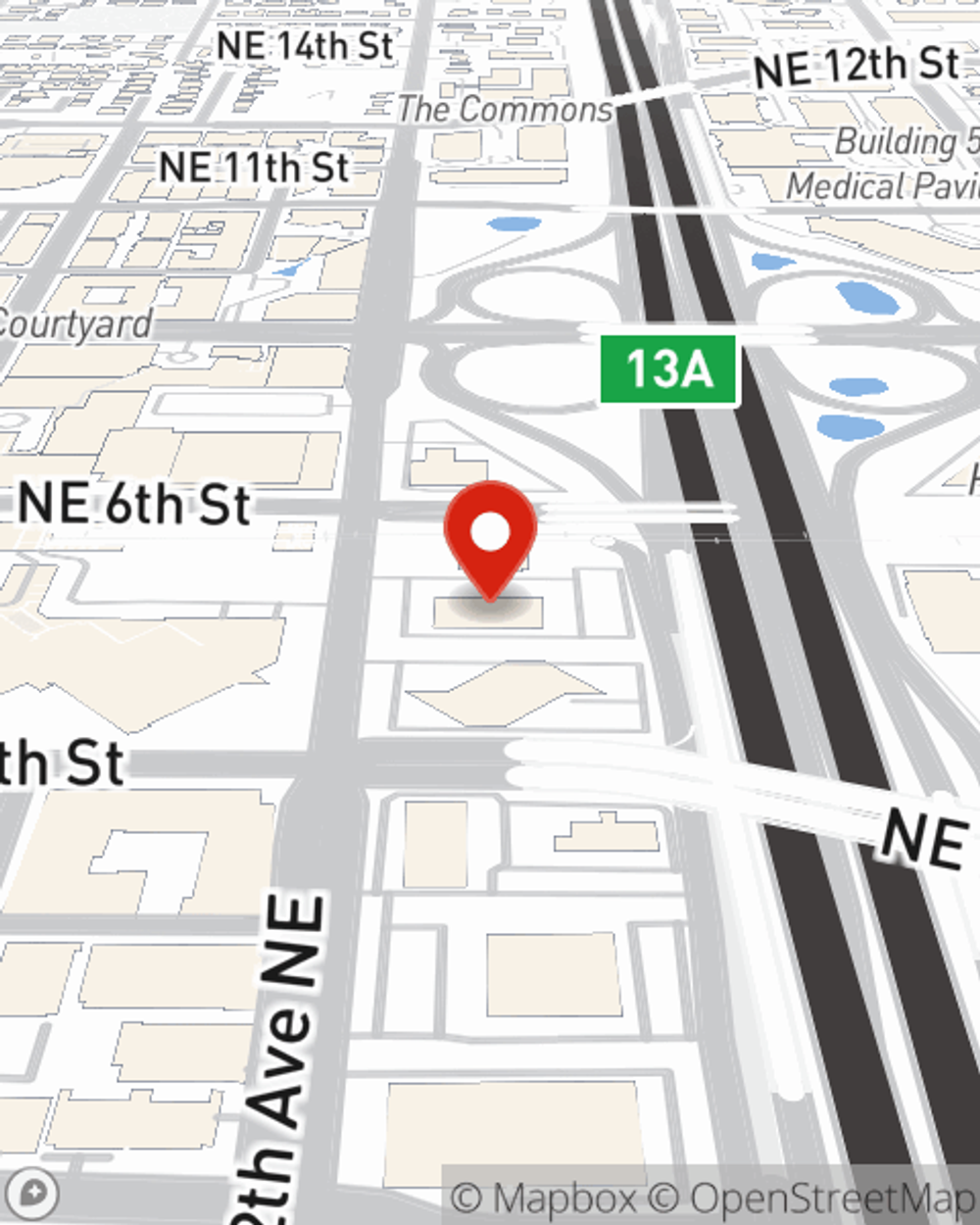

Life Insurance in and around Bellevue

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

No one likes to think about death. But taking the time now to secure a life insurance policy with State Farm is a way to extend care to your family if you're gone.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Life Insurance Options To Fit Your Needs

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Albert Tadevosyan. Albert Tadevosyan is the compassionate associate you need to consider all your life insurance needs. So if you die, the beneficiary you designate in your policy will help your family or the ones you hold dear with matters such as college tuition, ongoing expenses and medical expenses. And you can rest easy knowing that Albert Tadevosyan can help you submit your claim so the death benefit is issued quickly and properly.

When you and your family are insured by State Farm, you might rest assured that even if the worst comes to pass, your loved ones may be protected. Call or go online now and see how State Farm agent Albert Tadevosyan can help you protect your future.

Have More Questions About Life Insurance?

Call Albert at (425) 576-1800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Albert Tadevosyan

State Farm® Insurance AgentSimple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.